Pharmacy Reimbursement: How It Works and What You Need to Know

When you pick up a prescription, pharmacy reimbursement, the process by which pharmacies get paid by insurers or government programs for filling prescriptions. Also known as drug payment processing, it’s the hidden system that decides whether you pay $5, $50, or $500 for the same pill. This isn’t just about pharmacies getting paid—it’s about whether you can afford your meds at all.

Behind every filled script is a chain: your insurer sets a formulary, a list of covered drugs and their cost tiers. Also known as drug list, it determines which medications are approved and at what price point. If your drug isn’t on the list, or it’s in the highest tier, you pay more. Generic drugs often get preferred status because they cost less—pharmacies get reimbursed faster, and insurers save millions. That’s why pharmacists might switch your brand-name drug for a generic without asking, under presumed consent laws, rules allowing pharmacists to substitute generics unless the doctor or patient objects. Also known as automatic substitution, this practice keeps costs down but can confuse patients if they don’t know their meds changed.

But reimbursement doesn’t just depend on the drug. It’s shaped by your plan type—Medicare Part D, Medicaid, private insurance, or employer coverage—each with different rules. Some plans require prior authorization before they’ll pay. Others use step therapy, meaning you have to try cheaper drugs first. And then there are the hidden layers: copay assistance programs, manufacturer coupons, and pharmacy discount cards that aren’t part of your insurance but still lower your out-of-pocket cost. These aren’t scams—they’re tools built into the system to help people who can’t afford their meds.

Pharmacy reimbursement also ties into how drugs are priced in the first place. A pill might cost $100 to make, but the list price could be $500 because manufacturers know insurers will negotiate. Pharmacists don’t set those prices—they just fill the script and get paid based on the contract between the insurer and the pharmacy benefit manager (PBM). PBMs are middlemen who negotiate discounts and rebates, but those savings don’t always reach you. That’s why two people on the same plan can pay wildly different amounts for the same drug.

What you can control? Know your plan. Ask your pharmacist if there’s a cheaper alternative on your formulary. Check if your drug has a patient assistance program. Ask if you can switch to a 90-day supply to lower your copay. And if you’re denied coverage, appeal—it’s more common than you think.

Below, you’ll find real stories and guides that show how pharmacy reimbursement affects everyday people—from those switching to generics to those fighting insurance denials. These aren’t theory pieces. They’re lived experiences, practical tips, and hard truths about how the system works—and how to make it work for you.

6

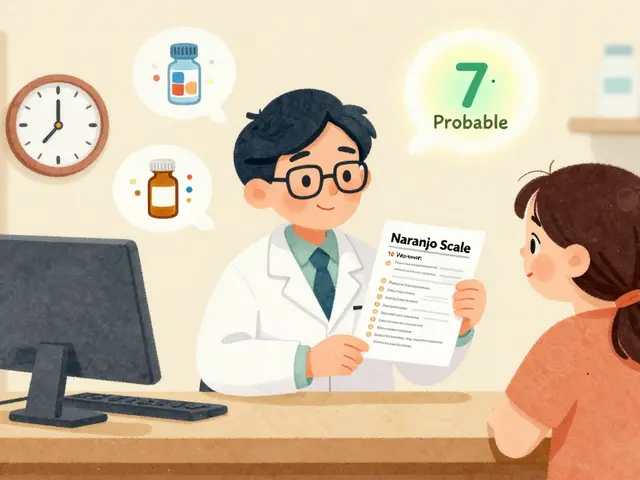

Pharmacy Reimbursement: How Generic Substitution Impacts Pharmacies and Patients Financially

Generic substitution saves money, but who really benefits? Pharmacy reimbursement systems favor PBMs over pharmacies and patients, with opaque pricing and spread pricing distorting incentives. Here’s how it works - and why it’s breaking independent pharmacies.